High Risk Match: Your One and Only Payment Partner!

Unleash Your Business Potential: Seamless High-Risk Payment Processing Solutions from Consultation to Cash Flow!

At High Risk Match, we put your business first! Enjoy a consultation with no fees and no hidden charges. Your success is our priority. If your account faces suspension or shutdown, count on us to fast-track your payment solutions. Bid farewell to third-party processors like Stripe, Square, Shopify, PayPal, and others!

1. Dynamic Consultation:

Kick off with a powerful consultation where our experts dive deep into your business needs and challenges. We'll uncover the best payment processing solutions tailored to your high-risk merchant account, setting the stage for your success.

2. Custom Solution Dev

Witness the magic as we craft a bespoke payment gateway solution just for you. From flexible payment options to tailored schedules and automated reminders, we design everything to meet your unique financial requirements and boost your business.

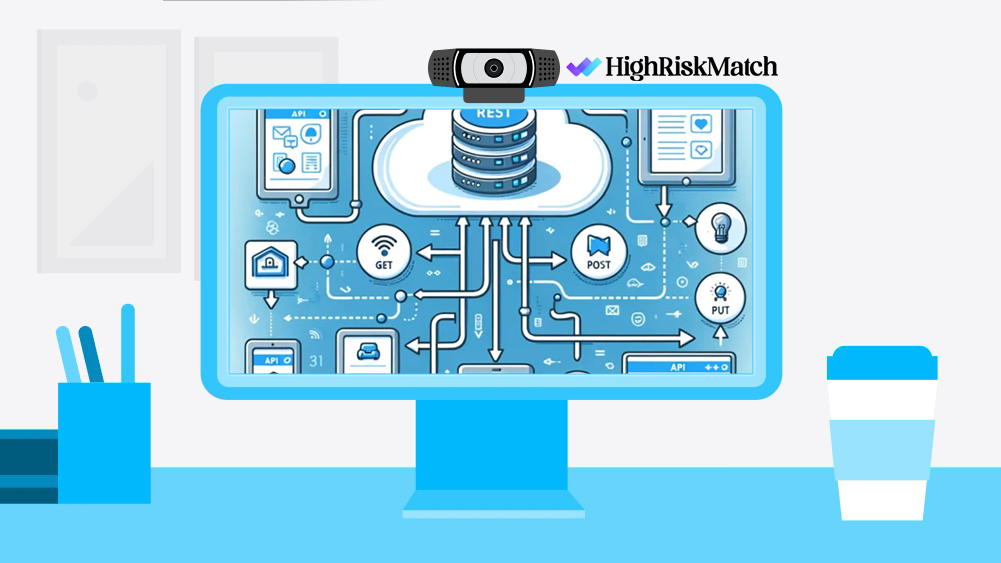

3. Effortless Integration:

Experience a seamless integration as our team works closely with you to embed the payment gateway into your systems. With minimal disruption, comprehensive training, and unwavering support, you'll be ready to take full control in no time.

4. Get Paid Instantly:

Once everything's set up, it's time to start accepting payments and watch your revenue soar. Our robust system ensures smooth operations, maximizes payment success rates, and keeps your financial operations running like a well-oiled machine. Get ready to elevate your business to new heights!

FEATURES

Together We Change The World

I’m also not going for what I would call an examined “instructional sentence.” I’d compiled hundreds of great sentences in a file of mine . , but when I examined, I realized most of them were designed to teach something to the reader. They contained some technique, some trick, some device that could be learned and replicated.

Airline Credit Card Payments:

With a reliable payment gateway, your airline can accept credit card payments from customers across the globe—ensuring a smooth experience regardless of their location. However, securing a payment processing partner for an airline business can be challenging, as the industry is considered high risk by many financial institutions.

Accounting:

As a tax preparation or accounting professional, your focus is on helping individuals and businesses manage their finances, especially during the busy tax season. Whether you operate year-round or only during the tax rush, accepting payments easily and securely is crucial to your business's success. For that, you’ll need a reliable accounting and tax prep merchant account to process credit card payments.

Adult

The adult industry faces unique challenges, especially when it comes to payment processing. Many traditional providers avoid working with adult businesses due to legal and regulatory risks, but at High-Risk Match, we specialize in providing reliable, secure, and customizable payment solutions for adult merchants. Whether you run an online platform, retail store, or offer subscription-based services, we are here to ensure seamless, compliant payment processing tailored to your needs.

Alcohol Merchant Account Solutions:

Running a beer, wine, or spirits business in the U.S. requires more than just a liquor license—you’ll also need a reliable alcohol merchant account to process customer payments. This specialized financial account allows you to securely accept credit cards, debit cards, ACH transfers, and eChecks, ensuring a smooth and efficient experience for your customers.

Automotive:

In today’s competitive automotive market, providing customers with convenient payment options is crucial. Whether you're running a repair shop, a car wash, or a dealership, the ability to accept credit and debit cards can significantly boost your sales. Without reliable credit card processing, you risk losing business as more customers expect quick and easy payment methods.

Bail Bonds:

A bail bonds merchant account allows businesses in the bail bonds industry to accept credit and debit card payments seamlessly. Despite the industry's essential role in the U.S. justice system, bail bond businesses often face challenges when it comes to finding reliable merchant account providers willing to facilitate their payments. Fortunately, High-Risk Match specializes in high-risk industries and has helped thousands of bail bond merchants secure credit card processing services.

Beauty Salon:

As a salon owner, balancing payment processing and business operations on top of your daily responsibilities can be overwhelming. A merchant service provider gives your business the ability to seamlessly handle your transactions and revenues with ease while elevating your salon's operations to another level. As a result, you can save resources, increase revenue, and build customer loyalty.

CBD Cannabis:

To accept credit cards, debit cards, and other popular payment methods, your CBD business needs a merchant account—a specialized bank account that processes transactions. Securing a CBD merchant account can be straightforward with High-Risk Match. Simply fill out our contact form, and one of our account managers will reach out to guide you through the process. Once your business’s details are assessed, your dedicated account manager will recommend the best payment solutions for your unique needs. After approval, you can begin processing payments as soon as the next day!

Cigars & Tobacco:

A tobacco merchant account allows retailers in the tobacco industry to accept credit and debit card payments. Due to the high-risk nature of this industry, securing a tobacco merchant account can be challenging. At High-Risk Match, we specialize in providing personalized payment solutions tailored to your business needs. Whether you're selling cigars, loose leaf tobacco, or other tobacco-related products, our expert team is here to assist you in obtaining the right merchant account for your business.

Cleaning Services:

At High-Risk Match, we make it easy for cleaning businesses to obtain a merchant account to accept payments securely. Unlike many traditional providers that only cater to low-risk businesses, High-Risk Match specializes in providing dedicated merchant accounts for a broad range of industries, including residential and commercial cleaning services. Whether you're a brand-new cleaning business or a well-established company, we’re here to help you get set up quickly and efficiently.

Online Clothing Stores:

The online marketplace has transformed the fashion industry. With the power of eCommerce, you can now bring your unique styles and products to customers worldwide. But to run a successful online clothing store, you need a reliable clothing store merchant account to process payments securely. Whether you're selling custom t-shirts, high-end fashion, or boutique accessories, High-Risk Match is here to help you integrate a payment gateway into your site, so you can accept online payments and grow your business.

Coaching and Seminars:

Running an online seminar or coaching business has never been more popular. With the ability to share knowledge and expertise across digital platforms, educators and professionals are tapping into new revenue streams. However, if you’re ready to take your seminar or training business to the next level, securing the right educational seminar merchant account is essential for credit card processing and growing your clientele.

Coins and Collectibles:

Selling coins and collectibles is a unique and often lucrative business, but it comes with challenges—especially when it comes to accepting credit card payments. At High-Risk Match, we specialize in providing high-risk merchant accounts for collectible businesses, helping you process payments securely and efficiently. Whether you’re selling rare coins, vintage items, or collectibles, we offer tailored payment solutions that meet your business’s needs.

Collection Agencies:

Debt collection agencies play a crucial role in the finance sector, with the market valued at over $26.4 billion in 2024. However, despite its size and importance, the debt collection industry is often labeled as high-risk by banks and payment processors, making it difficult for businesses to secure a merchant account. That’s where High-Risk Match steps in.

Debt Consolidation:

Securing a debt consolidation merchant account is far more challenging than it should be. Although debt consolidation plays a vital role in helping clients improve their financial situations, the industry is labeled as high risk by most banks. As a result, many traditional payment processors are reluctant to offer credit card processing services to these businesses.

Digital Downloads:

In today’s digital economy, offering paid digital downloads has become a powerful way for independent creators, artists, and large corporations to generate income. From eBooks to music files, selling digital products allows you to reach millions of potential customers around the world. However, to do this effectively, you need a reliable and secure payment gateway.

Document Preparation:

The document preparation industry is essential to global markets, supporting everything from debt settlement procedures to student loan applications and tax preparation services. With this high demand, processing payments efficiently is critical for business growth. Unfortunately, traditional payment processors often shy away from industries like document preparation, labeling them as high risk.

DropShipping:

Building, launching, and managing your own dropshipping website is a fantastic way to generate income without the need for physical inventory. The drop shipping model allows you to sell a wide variety of products directly from manufacturers, with minimal overhead costs. However, success in the dropshipping industry requires more than just a good business plan—you need reliable credit card processing that can handle the complexities of high-risk industries.

eCommerce:

Acquiring an eCommerce merchant account is one of the best decisions any business owner can make. With the right account, you can open your business to the world of credit card processing through an integrated payment gateway, making transactions simple, secure, and efficient.

Electronics:

Running an online electronics store offers tremendous opportunities for growth, but navigating the complexities of credit card processing in this space can be daunting. The electronics industry is considered high-risk by many traditional payment processors. That's where High-Risk Match comes in. We specialize in helping high-risk businesses like yours thrive, providing you with reliable, seamless credit card processing solutions.

Firearms:

Running a firearms business comes with unique challenges—especially when it comes to finding reliable credit card processing. Traditional payment processors often turn away or terminate accounts for firearm businesses. That’s where High-Risk Match steps in. With our extensive experience and gun-friendly merchant accounts, we ensure your business can process payments securely and efficiently without interruptions.

Health Clubs:

Whether your business is a gym, health club, fitness center, or yoga studio, reliable payment processing solutions are key to you and your customers. Streamline your payment processes with a merchant service provider that understands the unique needs of your gym business. That's where High-Risk Match comes in. We specialize in providing tailored solutions, helping you maximize your revenue while offering your clients seamless payment options.

Healthcare:

Your healthcare business focuses on providing excellent care to your patients and clients. However, collecting payments for your services is essential to continue providing care. At High-Risk Match, we help healthcare partners build payment processing systems specifically designed to meet their unique needs.

Hotel and Hospitality:

High-Risk Match is a full-service merchant account provider that offers everything your hotel needs to start accepting credit card payments seamlessly. From advanced hardware to industry-specific merchant services, we understand what our hotel clients require for success. We work closely with our customers to ensure our payment solutions are tailored to your business model, helping you maximize efficiency and revenue.

Hunting and Outdoor Equipment:

If you own a hunting and outdoor equipment business, expanding online is essential to keep up with the competition. Selling hunting and outdoor equipment online may seem simple enough, but it can quickly become tricky or even impossible without a dedicated high-risk merchant account for outdoor equipment.

HighTicket Transactions:

Managing a business that handles thousands of sales a month and high-ticket transactions requires a high-volume payment processing solution you can trust. As your business grows and scales, ensuring you have the capability to process sales seamlessly is imperative. However, high-volume businesses are often considered too risky for standard payment processors, putting your operations at risk of account freezes or terminations.

Insurance:

At High-Risk Match, we provide the most effective payment processing system for insurance companies, designed to simplify the processing of payments while enhancing communication with policyholders. We understand that insurance providers need reliable, efficient, and secure payment solutions to streamline every aspect of their operations. With our comprehensive insurance payment services, your business can run smoothly while staying ahead of the competition.

Jet Charters:

Owning a jet charter business offers a unique opportunity to connect with high-end clientele worldwide. Whether you're starting from scratch or looking to scale your existing business, accepting jet charter payments online is critical to your success. Being able to process payments online expands your reach, enhances client satisfaction, and ensures you don’t miss out on booking opportunities.

Law Firms:

Running your own law firm means balancing legal expertise with business management. One key way to streamline operations and enhance client convenience is by accepting credit card payments. Credit card processing allows clients to pay for legal services with ease, while law firms benefit from fast, secure, and efficient payment solutions.

MLM - Multi Level Marketing:

If you’re running a multi-level marketing (MLM) business, finding the right payment processing solution is essential to your success. Whether you’re selling beauty products, health supplements, or home goods, having the ability to accept credit card payments is crucial for scaling your business and expanding your customer base. However, many traditional payment processors classify MLM businesses as “high risk,” leading to challenges when it comes to securing reliable credit card processing services.

Moving and Transportation:

Providing clients with the freedom to pay from any location, using any card-not-present payment method, gives your business a competitive edge. At High-Risk Match, we understand the importance of this flexibility, which is why we offer secure and confidential transportation services virtual terminals tailored to your unique business needs.

Non-Profit:

Running a non-profit organization involves much more than just spreading awareness and fundraising. Managing donations, organizing events, and tracking donor engagement are all part of the puzzle. But one of the most critical elements of success is ensuring you have a reliable way to accept and process payments. With High-Risk Match, you can set up a non-profit merchant account that simplifies donations and ensures your operations run smoothly.

Nutraceutical:

The nutraceutical industry is a massive market, projected to reach a staggering $671 billion by 2024 worldwide. If you're selling supplements or nutraceutical products, your online presence is crucial to staying competitive. With High-Risk Match, you gain access to the payment solutions you need to run your nutraceutical business smoothly. We specialize in providing the nutraceutical merchant account you need to keep your business compliant and operational.

Online Dating:

If you operate an online dating business, having the ability to accept credit and debit card payments is essential. A merchant account is the backbone of these transactions, allowing your business to accept secure payments from customers. Given that card payments account for over 70% of all transactions in the U.S., it’s clear that offering this convenience is critical to your success.

Pawn Shop:

Pawn shops offer vital services, including short-term loans using valuable items as collateral, and a marketplace for second-hand goods. Whether you're running a local pawn shop or expanding into online sales, having the ability to accept credit and debit card payments is essential. With High-Risk Match, you can secure a merchant account specifically designed for the unique needs of pawn shops, ensuring seamless and secure payment processing.

Real Estate:

To accept payments for your real estate business, you need a merchant account and access to a payment gateway. A real estate merchant account is a specialized business bank account that enables you to accept various forms of payments, such as credit and debit card transactions. This applies to real estate agents, brokers, property management services, title companies, and investment firms.

Restaurants and Bars:

In today’s fast-paced dining industry, offering secure and efficient payment options is essential for success. Whether you own a restaurant, bar, or café, accepting a variety of payment methods not only increases your sales potential but also enhances the customer experience. High-Risk Match provides tailored merchant services for restaurants and bars, including point-of-sale systems, mobile processing, and online ordering solutions, all designed to fit the unique needs of your business.

SaaS Subscription Billing Solutions:

The SaaS (Software as a Service) industry continues to skyrocket in growth with the advent of social media and smartphone technology. Offering software as a service or subscription-based model can help attract more customers through the use of microtransactions. However, managing the financial aspect of SaaS requires secure and efficient payment processing.

Self-Defense Products:

The martial arts and self-defense industry continues to grow, making it a viable space for new businesses. If you're looking to start your own online self-defense business, you'll need to find a high-risk payment processor like High-Risk Match to accept card payments securely.

SEO and SEM Services:

In today’s digital age, more companies are turning to search engine optimization (SEO) to increase brand awareness and bring in new clients. It is the most cost-effective way to get your business’s website noticed. But this industry is complex and highly competitive. A new online SEO company seems to emerge every day at an alarming rate.

Smoking Accessories:

The global tobacco market, including smoking accessories, continues to see impressive growth. With such a lucrative market, offering smoking accessories such as bongs, pipes, and other paraphernalia online or in-store requires a reliable and secure payment processing system. That’s where High-Risk Match comes in.

Sports Betting:

Sports betting is a booming industry, and businesses providing sports betting advice thrive within this landscape. Whether big or small, nearly every sporting event has bets placed on it, and sports betting advice services are in high demand. These businesses offer expert insight to those looking to make bets and turn a profit based on well-informed picks. Whether you're offering advice for individual games, a season, or year-round, there's great potential for profitability.

Subscription Based Services:

The continuity economy has become one of the most successful business models in recent years, thanks to the convenience of subscriptions. Customers enjoy the ease of receiving goods and services on a recurring basis, while businesses benefit from predictable, steady revenue. But without the ability to accept credit card payments securely and efficiently, your subscription business could struggle to thrive.

Tech Support:

Securing a tech support merchant account to accept credit card payments online is a crucial next step for any IT or tech support business. Unfortunately, many banks and standard payment gateway providers blacklist these types of businesses due to increased risks of fraud and chargebacks. But with High-Risk Match, you can still secure a reliable payment gateway for your tech support business with the right high-risk provider and banking partnerships.

Utility Services:

If your business requires utility payment processing, look no further than High-Risk Match. Our experience in providing utility businesses with payment solutions ensures that we have all the tools you need to efficiently accept customer payments.

Electronic Cigarette and Vaping Products:

Securing an e-cigarette merchant account to sell e-cig and vape products online is a challenging process unless you partner with a reliable high-risk credit card processor. As a merchant in this space, you’ll find that many acquiring banks steer clear of this industry due to the risks associated with fraud and chargebacks. This places e-cigarette merchant accounts in the hard-to-place category. Fortunately, High-Risk Match is here to help. We specialize in high-risk payment processing, including vape and e-cig merchants, understanding that vaping has become a worldwide trend with massive demand.

Website Design:

As businesses increasingly invest in their online presence, having a well-designed and fully functional website has become essential. Studies show that a majority of consumers name website design as the most significant factor in determining a brand’s credibility. Poor design can lead to high cart abandonment and a lack of trust from customers. As more companies recognize the value of professional website design, the demand for web development services is rapidly growing, providing opportunities for web design companies to thrive.

WooCommerce:

Shopify:

Shopify is a leading e-commerce platform known for its user-friendly interface and extensive features. Despite its popularity, one significant issue that high-risk businesses face is account suspension. Unexpected suspensions can severely disrupt your business operations. In this blog, we will explore why Shopify might suspend or terminate accounts, the impact of such actions, and how High Risk Match can offer solutions to prevent and address these disruptions effectively.

Stripe:

Imagine this: Your business is thriving, sales are pouring in, and you’re on top of the world. Suddenly, you get the dreaded email—your account has been shut down. The payments stop, customers can’t complete their orders, and you’re left scrambling to pick up the pieces. If you’ve been down this road with Stripe, Shopify, Square, PayPal, or any other payment processor, you’re not alone. But guess what? It’s time to say goodbye to those sleepless nights and hello to High Risk Match!

Paypal:

Chargeback Representment Management

DisputeGenius™ helps merchants resolve chargeback disputes intelligently. Accept or dispute chargebacks with a single click.

Chargeback Analytics Management

The most comprehensive chargeback solutions are the ones built on a solid, data-based, analytical foundation

Chargeback Prevention Alerts

Strategies to prevent chargebacks begin with chargeback alerts. To protect your business from chargebacks, you need a solution that allows you to immediately receive and easily respond to alerts.

Chargeback Rapid Dispute Resolution

Combining Visa’s chargeback resolution tool with MidMetrics’ chargeback analytics dashboards allows merchants to automate chargeback dispute resolution, saving time and operating costs.

Essential Chargeback Protection for Merchants

Reduce chargebacks and friendly fraud with MidMetrics™ solutions for merchants. We can help you navigate the chargeback process, reduce fraudulent activity, streamline chargeback disputes and improve customer service all with a single solution.

High-risk payment processing refers to the specialized services provided to businesses that operate in industries or have characteristics deemed “high-risk” by financial institutions. These businesses face unique challenges when it comes to accepting credit card payments, managing transactions, and maintaining merchant accounts due to the higher likelihood of chargebacks, fraud, and other financial risks.

Understanding High-Risk Businesses

A business is considered high-risk for several reasons, including:

- Industry Type: Certain industries, such as online gambling, adult entertainment, pharmaceuticals, firearms, travel services, and CBD sales, are inherently riskier due to their nature. These industries often face stricter regulations, legal scrutiny, and higher rates of chargebacks.

- Business Model: Subscription services, recurring billing models, and multi-level marketing (MLM) schemes are considered high-risk because of their potential for high refund rates or customer dissatisfaction.

- Sales Volume: Businesses with high transaction volumes, especially in international markets, can be seen as high-risk because large sums of money are moving quickly, increasing the risk of fraud.

- Chargeback Ratios: A high chargeback ratio (the percentage of transactions disputed by customers) is a key indicator of risk. Businesses with a history of chargebacks or refunds are more likely to be labeled as high-risk.

- Credit History: Poor credit history, a history of bankruptcy, or previous merchant account terminations can lead to a business being classified as high-risk.

Why Do High-Risk Businesses Need Specialized Payment Processing?

High-risk businesses often struggle to obtain or maintain merchant accounts with traditional payment processors. Mainstream processors, like Stripe or PayPal, have strict risk management policies and may refuse to work with high-risk businesses or, worse, suspend or terminate accounts without warning.

High-risk payment processors specialize in working with these types of businesses, offering services specifically designed to manage the increased risks. These processors understand the unique challenges high-risk businesses face and provide tailored solutions that allow them to operate efficiently and securely.

High Risk Match: Your Partner in High-Risk Payment Processing

At High Risk Match, we understand the intricacies and challenges that come with operating a high-risk business. That’s why we’ve made it our mission to provide reliable, secure, and tailored payment processing solutions for businesses like yours. Here’s how we stand out:

Tailored Merchant Accounts:

- At High Risk Match, we don’t believe in one-size-fits-all. We create dedicated merchant accounts that are specifically tailored to your business’s needs, ensuring stability and reducing the risk of unexpected account termination.

Competitive Pricing:

- While high-risk processing typically comes with higher fees, we work hard to offer competitive pricing that reflects our commitment to your business’s success. Our goal is to provide value while managing risk effectively.

Advanced Fraud Prevention:

- Our sophisticated fraud prevention tools are designed to protect your business from potential threats. With real-time monitoring, multi-layered security protocols, and expert chargeback mitigation strategies, High Risk Match keeps your transactions secure.

Global Payment Solutions:

- Whether your business operates locally or internationally, High Risk Match supports global payment processing with multiple currencies. We ensure your business can thrive in any market, without barriers.

Unmatched Support:

- Our team of experts is always available to assist you, whether it’s optimizing your payment processing or resolving issues quickly. We pride ourselves on offering personalized support tailored to your business’s needs.

Why Choose High Risk Match?

Choosing High Risk Match means choosing a partner who understands your business’s unique challenges and is committed to helping you overcome them. We offer:

- Stability and Reliability: Unlike traditional processors, we understand the high-risk landscape and work to provide a stable payment environment tailored to your specific needs.

- Expert Guidance: With years of experience in high-risk industries, our team offers unparalleled expertise, helping you navigate the complexities of payment processing with confidence.

- Peace of Mind: With High Risk Match by your side, you can focus on growing your business, knowing that your payment processing is in capable hands.

The High Risk Match Difference

At High Risk Match, we’re more than just a payment processor—we’re your partner in success. We’re dedicated to providing high-risk businesses with the tools, support, and stability they need to thrive. Whether you’re dealing with high chargebacks, navigating regulatory challenges, or expanding globally, High Risk Match is here to ensure your payment processing is seamless and secure.

Ready to experience the High Risk Match difference? Contact us at info@highriskmatch.com or call 1-877-242-2009 today to learn more about how we can support your business.