The Backbone of Your Business: Understanding Payment Processing with High Risk Match

In today’s fast-paced digital world, payment processing is the lifeblood of any business, especially for those operating in high-risk industries. Whether you’re a seasoned entrepreneur or just starting, mastering the art of payment processing is crucial to ensuring smooth and secure transactions for your customers.

Imagine this: Your online store is buzzing with activity. Customers are adding items to their carts, ready to complete their purchases. Everything is going perfectly—until a payment processing error pops up. Transactions are stalled, customers are frustrated, and suddenly, your flourishing business faces a serious roadblock. This is where High Risk Match steps in to make sure such scenarios become a thing of the past.

What Is Payment Processing?

At its core, payment processing is the mechanism that facilitates the transfer of money from your customer’s bank account to your merchant account. It involves multiple players—customers, merchants, payment gateways, processors, and financial institutions—all working in harmony to ensure that funds are securely and efficiently moved.

High Risk Match simplifies this complex process for high-risk businesses, ensuring that every transaction is not only smooth but also secure, giving you the peace of mind to focus on growing your business.

How Does Payment Processing Work?

Navigating the intricacies of payment processing, especially for high-risk businesses, requires an understanding of the key components and potential challenges. High Risk Match excels in addressing these challenges, focusing on transparency, security, and technical support—elements that are vital in building trust and demonstrating expertise in payment processing.

1. Transparent and Predictable Pricing

The Challenge: A common pain point for businesses is the lack of transparency in pricing structures, which often leads to unexpectedly high fees.

Our Solution: At High Risk Match, we offer a flat-rate pricing model that brings predictability to your expenses. No more surprise fees—just clear, upfront costs that allow you to manage your finances with confidence.

2. Advanced Security Measures

The Challenge: With the rise of online payments, the risk of fraud and data breaches has become a significant concern.

Our Solution: Security is at the heart of what we do. High Risk Match ensures that your payment systems are PCI compliant, and we go the extra mile by implementing firewalls, bot protection, and regular purging of old records. Our state-of-the-art fraud detection tools help mitigate risks, ensuring that your business remains protected and your customers’ trust is maintained.

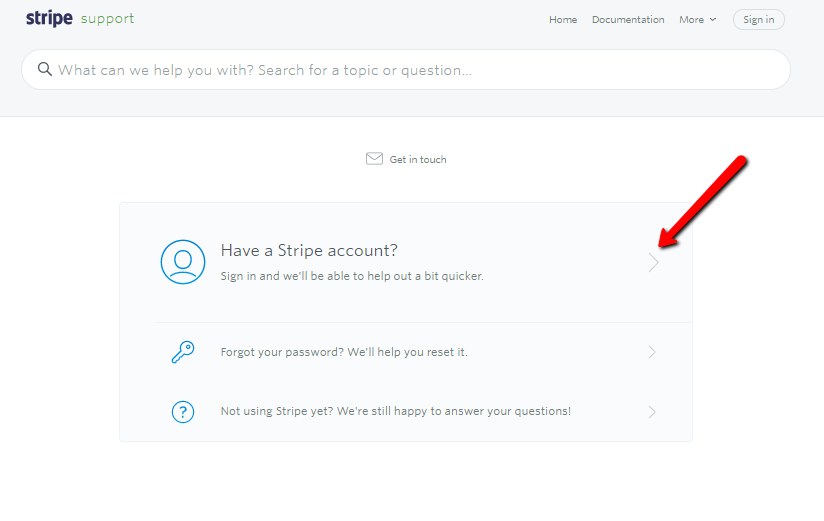

3. Seamless Integration and Unmatched Support

The Challenge: Integrating new payment systems with your existing operations can be daunting, especially when it comes to minimizing disruptions.

Our Solution: High Risk Match offers seamless integration with your existing business software, whether it’s an e-commerce platform or a POS system. Our solutions reduce manual work, minimize errors, and enhance overall efficiency. Plus, our 24/7 customer support ensures that any issues are quickly addressed, minimizing downtime and keeping your operations running smoothly.

4. Catering to Modern Consumer Preferences

The Challenge: Today’s consumers expect a variety of payment options. Limiting payment methods can result in lost sales and lower customer satisfaction.

Our Solution: High Risk Match supports multiple payment channels, including credit cards, debit cards, and digital wallets. By accommodating your customers’ preferred payment methods, we help you reduce cart abandonment rates, boost sales, and enhance overall customer satisfaction.

The Anatomy of Payment Processing

To fully understand how payment processing works, it’s important to break down the process into its key components:

Transaction Initiation

The customer initiates the transaction by providing their payment information, typically through a payment gateway on your website.

Authorization

The payment processor validates the transaction details. The issuing bank then checks the customer’s account status and either approves or declines the transaction.

Settlement

Once authorized, the funds are transferred from the issuing bank to the acquiring bank, where they are deposited into your merchant account.

Best Practices for Secure and Efficient Payment Processing

Running a successful business involves more than just selling great products; it’s about offering a seamless, secure, and efficient payment experience. Here are some best practices to keep your payment processing optimized:

1. Embrace Robust Security Protocols

Ensure that your payment processing system is PCI DSS compliant. Regularly updating your security measures, such as installing firewalls and bot protection, helps safeguard your business from fraud and data breaches.

2. Offer Diverse Payment Options

Cater to your customers by providing various payment methods. From traditional credit and debit cards to digital wallets, offering flexibility can significantly improve conversion rates and customer satisfaction.

3. Stay Updated with Technology

Regularly update your payment processing software and hardware to keep up with technological advancements. This not only enhances efficiency but also ensures that your systems remain secure and reliable.

4. Train Your Team

Educate your employees on payment processing best practices and fraud prevention techniques. A well-trained team can help maintain transaction security and contribute to a culture of vigilance.

5. Implement Fraud Prevention Tools

Leverage advanced fraud detection and prevention tools to monitor transactions for unusual activity. These tools are essential in protecting both your business and your customers from financial loss and reputational damage.

Why Choose High Risk Match?

At High Risk Match, we’re more than just a payment processor—we’re your partner in success. Here’s why businesses choose us:

- Proven Expertise: We specialize in high-risk industries and understand the unique challenges you face.

- Comprehensive Support: Our 24/7 customer support is always here to help, ensuring that any issues are resolved quickly.

- Cutting-Edge Security: We provide robust security measures that protect your business from fraud and chargebacks.

Ready to Transform Your Payment Processing?

Don’t let payment processing challenges hold your business back. With High Risk Match, you can expect transparent pricing, unparalleled security, and seamless integration tailored to your needs.

Get in Touch Today:

- Email: info@highriskmatch.com

- Phone: 1-877-242-2009

Take Action Now:

Request a Demo: Experience our payment solutions firsthand and see how they can benefit your business.

Get Started: Contact us to explore how our solutions can help you streamline your payment processing.

Book a Consultation: Schedule a consultation with our experts to discuss your business needs.

Meta Description: Discover how High Risk Match simplifies payment processing for high-risk businesses, offering transparent pricing, robust security, and seamless integration to keep your operations running smoothly.

Keywords: Payment processing, high-risk merchant account, transparent pricing, fraud prevention, multi-channel payments, payment gateway integration

<meta name=”description” content=”Discover how High Risk Match simplifies payment processing for high-risk businesses, offering transparent pricing, robust security, and seamless integration to keep your operations running smoothly.”> <meta name=”keywords” content=”Payment processing, high-risk merchant account, transparent pricing, fraud prevention, multi-channel payments, payment gateway integration”>