Stripe is a popular payment processor known for its user-friendly interface and robust features. However, businesses operating in high-risk sectors often encounter challenges when using Stripe. Understanding why these issues arise can help you navigate payment processing better and find suitable solutions. Here’s a deep dive into why high-risk businesses frequently face issues with Stripe and how High Risk Match can provide the support you need.

Common Issues High-Risk Businesses Face with Stripe

1. Chargeback Risks

High-risk industries are more susceptible to chargebacks—when customers dispute transactions. This elevated risk can trigger Stripe’s risk management protocols, potentially leading to account holds or terminations. For example, subscription-based services or digital products often experience high chargeback rates, which can strain their relationship with Stripe.

2. Fraud Prevention Measures

Stripe’s fraud detection systems are designed to protect against fraudulent transactions, but high-risk businesses might find their transactions frequently flagged or blocked. This is particularly common in sectors with high ticket values or digital goods. The stringent fraud checks can impact legitimate transactions, causing frustration for both businesses and their customers.

3. Regulatory and Compliance Concerns

Certain high-risk industries face complex regulatory requirements that can complicate compliance efforts. For instance, online gambling or adult content businesses may encounter additional scrutiny and regulations. Stripe’s policies may reflect these concerns, making it harder for businesses in these sectors to maintain an account.

4. High Transaction Volumes

Businesses with significant transaction volumes, especially those in high-risk sectors, might trigger Stripe’s risk management protocols. This is often the case with high-frequency trading platforms or businesses with large sales volumes. Stripe’s account management policies may become more restrictive to mitigate the associated risks.

5. Chargeback Fees and Penalties

High-risk businesses are often subject to higher chargeback fees and penalties. Stripe’s policies regarding these fees can be more stringent, leading to potential account issues. For example, a business with a high chargeback rate may incur substantial fees and face reserve requirements.

6. Industry-Specific Restrictions

Some high-risk industries come with specific restrictions imposed by Stripe, which can lead to account limitations or even suspension. Businesses in sectors like online pharmaceuticals or adult entertainment may face more rigorous policies and compliance requirements.

How High Risk Match Can Help You Thrive

If you’re operating in a high-risk industry and finding Stripe’s solutions lacking, High Risk Match is here to offer a more specialized and comprehensive approach tailored to your unique needs. Here’s how we stand out:

1. Custom Payment Solutions

High Risk Match specializes in developing payment processing solutions that are custom-tailored to the specific challenges of high-risk sectors. Unlike generic platforms like Stripe, our solutions are crafted with your industry’s unique needs in mind. We offer:

- Industry-Specific Payment Gateways: Whether you’re in sectors like adult entertainment, CBD, or online gaming, our payment gateways are designed to handle the intricacies of your transactions.

- Flexible Integration Options: Seamlessly integrate with your existing systems using our adaptable APIs and plugins, ensuring a smooth and efficient payment experience.

2. Advanced Fraud Prevention

Fraud prevention in high-risk industries requires a nuanced approach. High Risk Match provides advanced, multi-layered fraud detection and prevention systems that are far superior to the standard tools offered by Stripe:

- Proprietary Fraud Detection Algorithms: Our sophisticated algorithms analyze transaction patterns and detect fraudulent behavior with high precision, minimizing false positives and ensuring legitimate transactions are processed without delay.

- Real-Time Monitoring: Continuous monitoring of transactions helps identify and address suspicious activities as they occur, reducing the risk of fraud-related losses.

3. Regulatory Compliance Support

Navigating the regulatory landscape is crucial for high-risk businesses. High Risk Match offers robust support to ensure that your payment processing adheres to the latest industry standards and legal requirements, going beyond what Stripe provides:

- Dedicated Compliance Experts: Our team of compliance specialists stays updated with evolving regulations and helps you implement necessary adjustments to maintain compliance.

- Customized Compliance Solutions: We offer tailored compliance solutions that address the specific regulatory challenges of your industry, whether it’s PCI-DSS, GDPR, or other relevant standards.

4. Enhanced Account Stability

Maintaining account stability is a significant concern for high-risk businesses. High Risk Match offers solutions designed to enhance account stability and prevent common issues faced with traditional processors like Stripe:

- Dedicated High-Risk Merchant Accounts: We provide merchant accounts specifically designed for high-risk industries, ensuring greater stability and reliability.

- Proactive Account Management: Our account managers work closely with you to monitor account health and address potential issues before they escalate, providing you with ongoing support and stability.

5. Superior Customer Service

Our commitment to high-risk businesses extends to exceptional customer service that goes beyond what Stripe can offer:

- 24/7 Support: Access round-the-clock support from our team of experts (real people- not emails) who understand the nuances of high-risk industries and are dedicated to resolving your issues promptly.

- Personalized Service: Receive personalized assistance tailored to your business’s unique needs, ensuring that you get the support you need when you need it.

At High Risk Match, we understand the complexities of high-risk industries and offer solutions specifically designed to address these challenges. Our expertise and tailored services are here to help you thrive where traditional processors fall short. Reach out to us to discover how we can help you achieve seamless payment processing and greater business stability.

For more information on how High Risk Match can enhance your payment processing and address issues you may face with Stripe, contact us at info@highriskmatch.com or call 1-877-242-2009.

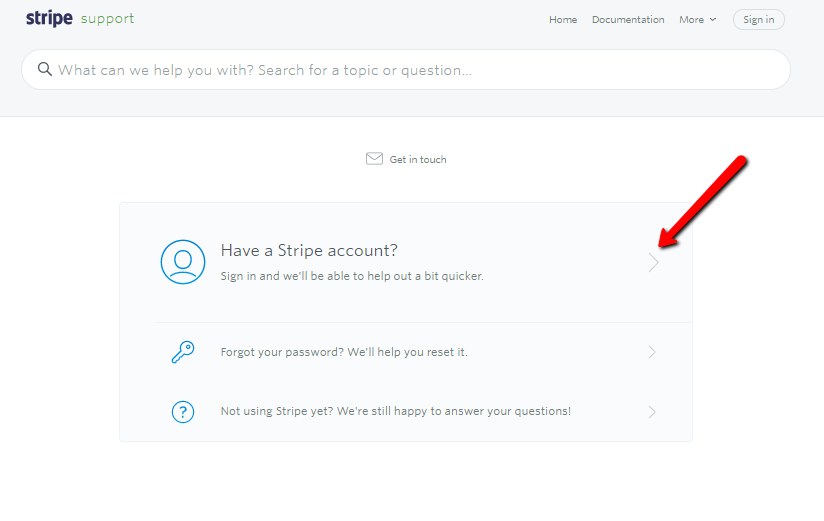

Stripe Support: https://support.stripe.com/?referrerLocale=en-gb-ca

Meta Description: High-risk businesses often face issues with Stripe due to chargebacks, fraud concerns, and regulatory challenges. Discover how High Risk Match offers tailored solutions for high-risk industries.

Keywords: Stripe Payment Issues, High-Risk Business Solutions, Payment Processing, Chargeback Risks, Fraud Prevention, High Risk Match

Tags: Stripe, High-Risk Businesses, Payment Processing, Fraud Prevention, Chargebacks, High Risk Match