Empower Your Business with Payment Solutions for Poor Credit: High Risk Match Has You Covered

In today’s competitive market, having poor credit can feel like a significant hurdle, especially when it comes to securing reliable payment processing solutions. But fear not—High Risk Match is here to turn your credit challenges into opportunities for growth and success. Imagine a payment processing system that not only accommodates your less-than-perfect credit but also supports your business goals. With High Risk Match, this is your new reality.

Why Payment Processing Matters for Businesses with Poor Credit

Payment processing is a critical component of any business, and it becomes even more crucial for those with poor credit. Access to reliable payment solutions ensures that transactions are handled smoothly and securely, regardless of credit history. High Risk Match specializes in providing payment solutions tailored to businesses with credit challenges, ensuring that you can focus on growing your business without financial constraints.

How High Risk Match Supports Businesses with Poor Credit

1. Tailored Payment Processing Solutions

The Challenge: Businesses with poor credit often face difficulties in securing traditional payment processing services, which can hinder their operations.

Our Solution: High Risk Match offers specialized payment processing solutions designed for businesses with poor credit. Our services are tailored to meet your unique needs, ensuring that you have access to reliable and efficient payment processing, even with a low credit score.

2. Flexible Credit Requirements

The Challenge: Traditional payment processors often have stringent credit requirements that can be a barrier for businesses with poor credit.

Our Solution: We understand that credit scores don’t always reflect the true potential of a business. High Risk Match provides flexible credit requirements, allowing businesses with poor credit to access the payment processing solutions they need. Our goal is to support your business regardless of your credit history.

3. Advanced Security Measures

The Challenge: Securing transactions and protecting sensitive customer information is essential, especially for businesses with poor credit that may face additional scrutiny.

Our Solution: High Risk Match prioritizes security with advanced fraud prevention and PCI-DSS compliance. We use cutting-edge technology to safeguard your transactions and protect your business from potential security threats. With us, you can trust that your payment processing is both secure and reliable.

4. Seamless Integration

The Challenge: Integrating payment processing solutions with existing systems can be challenging, especially for businesses facing financial difficulties.

Our Solution: High Risk Match offers seamless integration with various e-commerce platforms and POS systems. Our solutions are designed to work smoothly with your existing infrastructure, minimizing disruptions and ensuring that your payment processing runs efficiently.

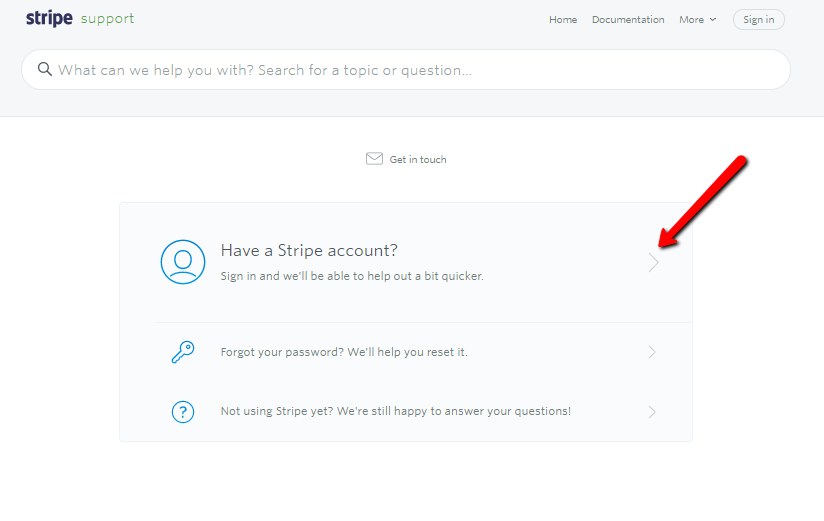

5. Dedicated Customer Support

The Challenge: Access to reliable customer support is crucial, especially when dealing with payment processing issues that can impact your business operations.

Our Solution: Our dedicated team at High Risk Match provides round-the-clock customer support to address any concerns you may have. We are committed to ensuring that your payment processing experience is smooth and stress-free, offering assistance whenever you need it.

Best Practices for Managing Payment Processing with Poor Credit

To optimize your payment processing while managing poor credit, consider these best practices:

1. Choose a Provider That Understands Your Needs

Select a payment processor that specializes in working with businesses with poor credit. High Risk Match offers solutions specifically designed for your situation.

2. Focus on Security

Ensure that your payment processing provider uses advanced security measures to protect your transactions and customer data. High Risk Match prioritizes security to safeguard your business.

3. Optimize Integration

Work with a provider that offers seamless integration with your existing systems. High Risk Match’s solutions are designed to integrate smoothly with your current infrastructure.

4. Leverage Customer Support

Utilize the customer support services provided by your payment processor. High Risk Match offers dedicated support to help you resolve any issues quickly and effectively.

5. Monitor Your Transactions

Regularly review your payment processing reports to identify any discrepancies or issues. This practice helps ensure that your transactions are processed accurately and efficiently.

Why High Risk Match Is the Ideal Choice for Businesses with Poor Credit

High Risk Match is uniquely positioned to support businesses with poor credit due to our:

- Specialized Solutions: Tailored payment processing solutions designed specifically for businesses with credit challenges.

- Flexible Requirements: Adjustable credit requirements to accommodate your business’s needs.

- Advanced Security: Robust security measures to protect your transactions and customer data.

- Seamless Integration: Easy integration with your existing systems to ensure smooth operations.

- Dedicated Support: Comprehensive customer support to assist with any payment processing concerns.

Ready to Enhance Your Payment Processing Experience?

Don’t let poor credit hold your business back. With High Risk Match, you can access reliable, secure, and efficient payment processing solutions tailored to your needs.

Contact Us Today:

- Email: info@highriskmatch.com

- Phone: 1-877-242-2009

Take Action Now:

- Get Started: Discover how our payment solutions can help your business thrive despite credit challenges.

- Schedule a Consultation: Speak with our experts to find the best payment processing solutions for your situation.

- Request a Demo: See how our solutions work in action by requesting a demo today.

Meta Description: Struggling with poor credit but need reliable payment processing? Discover how High Risk Match can provide tailored solutions for businesses with less-than-perfect credit histories.

Keywords: Payment processing for poor credit, high-risk merchant accounts, payment solutions for businesses with bad credit, secure transactions for poor credit, merchant services for low credit scores, financial solutions for poor credit businesses, high-risk payment processing

<meta name=”description” content=”Struggling with poor credit but need reliable payment processing? Discover how High Risk Match can provide tailored solutions for businesses with less-than-perfect credit histories.”> <meta name=”keywords” content=”Payment processing for poor credit, high-risk merchant accounts, payment solutions for businesses with bad credit, secure transactions for poor credit, merchant services for low credit scores, financial solutions for poor credit businesses, high-risk payment processing”>