Achieving and maintaining PCI Compliance can be a daunting task for small businesses, often due to limited resources and expertise. Despite these challenges, PCI Compliance is essential for safeguarding cardholder information and avoiding potential penalties. Here’s a comprehensive guide on the specific challenges small businesses face with PCI Compliance and the solutions to address them. High Risk Match is here to provide support and expertise to help small businesses navigate these challenges effectively.

Common Challenges for Small Businesses

1. Limited Resources and Budget

- Challenge: Small businesses often have limited financial and technical resources to invest in comprehensive security solutions and compliance measures.

- Solution: Utilize cost-effective, scalable security solutions such as cloud-based services that offer robust PCI Compliance features without significant upfront investments. High Risk Match can provide affordable, PCI-compliant payment processing solutions tailored to your budget.

2. Lack of In-House Expertise

- Challenge: Small businesses may lack the technical expertise required to understand and implement PCI DSS requirements effectively.

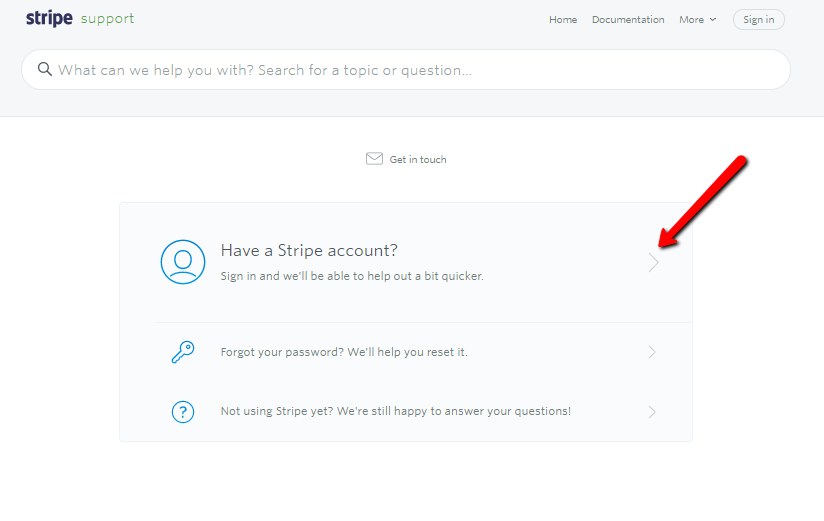

- Solution: Engage with PCI Compliance consultants or managed security service providers (MSSPs) who can offer expert guidance. High Risk Match provides expert advice and support to help you navigate PCI DSS requirements and implement necessary measures.

3. Complex and Evolving Requirements

- Challenge: PCI DSS requirements can be complex and are subject to updates, making it challenging for small businesses to stay current.

- Solution: Implement tools and services that automate compliance tasks and stay updated on PCI DSS changes. High Risk Match offers ongoing support to ensure your compliance measures evolve with industry standards.

4. Security and Data Protection

- Challenge: Ensuring the security of cardholder data with limited resources can be difficult for small businesses.

- Solution: Invest in essential security technologies like data encryption, tokenization, and secure payment gateways. High Risk Match’s PCI-compliant payment solutions include these technologies to protect your cardholder data effectively.

5. Employee Training and Awareness

- Challenge: Small businesses may struggle to provide adequate training on PCI Compliance and security best practices to employees.

- Solution: Utilize online training programs and resources to educate employees on PCI Compliance requirements and data security practices. High Risk Match can assist in developing and implementing effective training programs for your team.

6. Managing Compliance Documentation

- Challenge: Keeping track of compliance documentation and maintaining records can be overwhelming for small business owners.

- Solution: Use compliance management tools to organize and track documentation. High Risk Match helps you with documentation processes and provides guidance on maintaining necessary records for PCI Compliance.

How High Risk Match Supports Small Businesses

Affordable Compliance Solutions: High Risk Match offers cost-effective, PCI-compliant payment processing solutions that fit the needs and budgets of small businesses. Our solutions are designed to provide robust security without breaking the bank.

Expert Guidance and Support: Our team provides expert advice on PCI Compliance, helping you understand and implement the necessary measures. We offer support throughout the compliance process to ensure your business meets all requirements.

Scalable Security Technologies: We provide access to scalable security technologies, such as encryption and tokenization, that grow with your business. Our solutions ensure your cardholder data is protected and compliant with PCI DSS standards.

Ongoing Compliance Assistance: High Risk Match offers continuous support to keep you updated on PCI DSS changes and maintain compliance. We help you stay current with evolving requirements and manage your compliance documentation effectively.

Employee Training: We assist in developing and implementing training programs to educate your employees on PCI Compliance and data security best practices.

By partnering with High Risk Match, small businesses can navigate the complexities of PCI Compliance with confidence. Our tailored solutions and expert support make it easier for you to achieve and maintain compliance while focusing on growing your business.

For more information on how High Risk Match can help your small business with PCI Compliance, contact us at info@highriskmatch.com or call 1-877-242-2009.

Meta Description: Discover the specific challenges small businesses face with PCI Compliance and explore effective solutions. Learn how High Risk Match can support your business with affordable, scalable, and expert compliance assistance.

Keywords: PCI Compliance for Small Businesses, PCI DSS, Small Business Security, Compliance Solutions, Data Protection, Encryption, Tokenization, Employee Training, High Risk Match

Tags: PCI Compliance, Small Business, Data Security, Compliance Solutions, Encryption, Tokenization, Employee Training, High Risk Match